In March 2021 the Australian Taxation Office (“ATO”) released long awaited draft guidance for professionals, including those in the medical field. Unfortunately, the revised draft guidance is likely to increase scrutiny on medical professionals compared to previously published guidance from the ATO.

The draft guidelines outline how the ATO intends to determine whether an individual professional practitioner (“IPP”) is declaring an appropriate amount of business profits in their personal tax return relative to the value of the services they personally provide to their business.

The new guidance differs from previously published guidance by referring to the income from the whole of firm group. This includes income from service entities and other businesses associated with the medical practice, to which the practitioner and their associated entities (including their spouse) are entitled to receive. As it is common for medical practitioners to have a service entity in their group, you need to be aware of how the ATO will apply the new guidance to your circumstances.

While there have been no changes to Australia’s tax laws in relation to the sharing of business profits, the ATO are continuing their approach of issuing non-binding administrative statements in order to encourage medical professionals to pay ‘their fair share of tax’ or risk being audited.

Overview of guidance

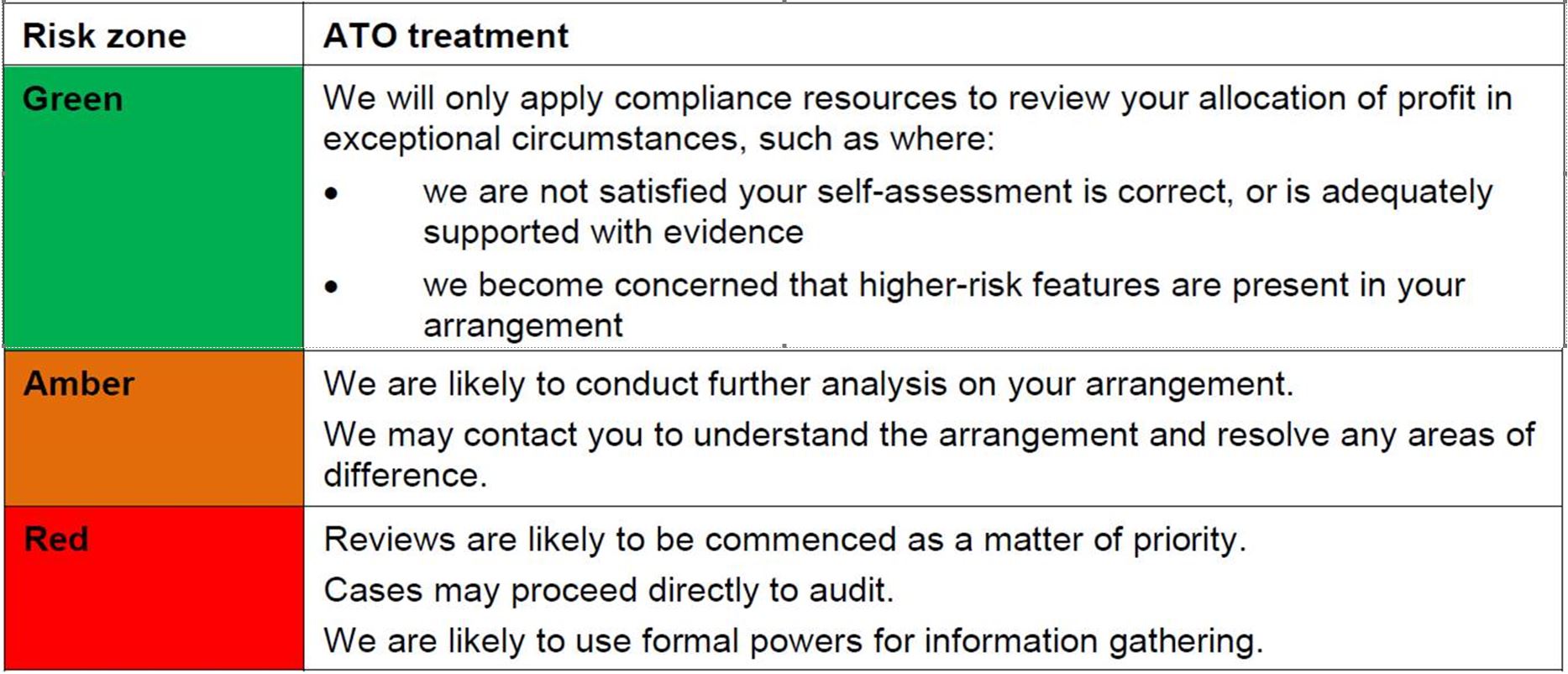

The guidance explains the ATO’s risk-based compliance approach and metrics to determine whether an arrangement would be considered low, medium or high risk. Where arrangements are not low risk or there is a lack of apparent commercial rationale, the ATO is likely to take a closer look at the arrangement and consider whether the anti-avoidance provisions apply.

There are strict criteria as to whether the guidance is applicable to an individual or practice, however it is intended to apply to most professional businesses, including medical practices. Importantly, if your business exhibits high-risk features, the ATO will automatically consider the business to be high-risk without applying the scorecard below.

Where the business is not considered to be high-risk and the guidance is applicable, a risk assessment scoring grid will be used to determine your risk level.

Where it is impractical to accurately determine an appropriate commercial remuneration against which to benchmark, the first two risk assessment factors may be used.

On the surface, most medical practitioners will be low risk, as they derive personal exertion income. This means that the practitioner should already be declaring income from patients in their own tax return regardless of whether the business for earning patient income is structured as a sole trader, company or trust. Due to the patient income being declared in their personal tax return, the medical practitioner will be paying tax at the top marginal rate. However, the risk assessment can increase when service entity income is included, along with income from any other businesses associated with the medical practice, as this income is often not declared in the practitioner’s name and may be directed to another associated entity including their spouse.

ATO Treatment

Depending on your risk zone, you can expect different treatment by the ATO:

As there have not been any changes to the law, this scrutiny will have an overlay of existing laws such as the general anti-avoidance rules, trust reimbursement arrangements (Section 100A), private company benefit and loan provisions (Division 7A) and other integrity provisions (such as the guidelines to calculate service fees).

Once finalised, the guidance is expected to apply prospectively from 1 July 2021 with a review being conducted during 2022.

Example

George is a gastroenterologist and has earned taxable income of $400,000 during the year from seeing patients. He is a sole trader and this income appears in the business schedule of his tax return. George also has a service trust in his group. The service trust has net income of $80,000 for the year, which has been distributed to George’s wife, Jane. George and Jane have no other income and no other deductions. The whole of firm income is $480,000.

George’s proportion of profit entitlement is 83% (being $400,000/$480,000). Therefore, under risk assessment factor 1, the group score is 2.

George pays tax (excluding Medicare levy) of $150,667 on his taxable income of $400,000. Jane pays tax of $16,467 (excluding Medicare levy) on her taxable income of $80,000. The total tax paid for the year is $167,134 on the total income of $480,000, which is an effective tax rate of 35%. This gives the group a score of 3 under risk assessment factor 2.

The total risk score is 5, which places George’s group in the green risk zone ie. low risk level.

What should I do now?

This draft guidance highlights the importance of ensuring you obtain professional advice prior to restructuring or joining a medical practice. Medical practitioners also need to consider how they calculate service fees for related parties and the distribution of profits from a service entity.

Should you wish to discuss your group’s circumstances to understand how the new guidance applies to you, please contact Kristy Baxter from Pilot’s medical services division on (07) 3023 1300 or taxmed@pilotpartners.com.au.